⚡ TL;DR – Toncoin Price Prediction 2025-2031

- Current Price: $1.65 (down 80% from $8.24 ATH in June 2024)

- 2025 Target: $6.35 potential high (285% upside from current levels)

- 2027 Forecast: $9.26-$11.49 range (crossing the $10 milestone)

- 2031 Projection: $48.12 potential high (2,816% from current price)

- Bull Case: Telegram integration, $300M+ TVL, institutional backing, vibrant community

- Bear Case: 68% whale concentration, bearish technicals, trading below 200-day SMA, extreme fear sentiment

- Bottom Line: Long-term bullish outlook tempered by significant short-term risks. Not financial advice—DYOR.

Toncoin Price Prediction 2025-2031: Can TON Really Hit $48 by 2031?

A data-driven forecast analyzing TON’s technical setup, fundamental catalysts, and long-term growth trajectory through 2031.

Sarah Rodriguez

On-Chain Analyst & Market Trader | December 30, 2025

Look, I’m going to be straight with you.

Toncoin is trading at $1.65 with a market cap of $4.05B as of December 28, 2025. After reaching an all-time high of $8.24 in June 2024, TON has entered a bear phase. The Fear & Greed Index is screaming “Extreme Fear” at 24. Technical indicators are predominantly bearish. Only 17 out of the last 30 days were green.

But here’s what most traders are missing: the long-term setup is still intact.

This isn’t about next week or next month. This is about the next six years. And the data tells a story that’s worth paying attention to.

The Long-Term Vision: A Bullish Outlook Built on Data

Let me show you the numbers first, then we’ll dig into whether they’re realistic.

2025 Forecast: $6.35 potential high. That’s a 285% gain from current levels.

2027 Forecast: $9.26-$11.49 expected range. This is when TON crosses the psychological $10 barrier.

2030 Forecast: $28.31-$34.81 expected range. We’re talking about a 17x-21x from today’s price.

2031 Projection: $48.12 potential high. If this plays out, early buyers at $1.65 would see a 2,816% return.

Sounds aggressive? It is.

But before you dismiss this as hopium, let me walk you through the foundation behind these numbers. Because unlike most crypto predictions that pull figures out of thin air, this forecast is built on a combination of technical analysis, fundamental catalysts, and historical market behavior.

What Exactly Is Toncoin? (The Foundation)

If you’re new to TON, here’s the quick version.

Toncoin was originally designed by Telegram—yes, the messaging app with over 700 million users. After regulatory issues forced Telegram to step back, the project became community-driven and rebranded as “The Open Network.”

The technology is impressive: a distributed “supercomputer” protocol composed of TON Blockchain, TON DNS, TON Storage, and TON Sites. The mission? Enable rapid transactions and support a wide array of decentralized applications.

Toncoin (TON) is the native token that powers this ecosystem. It’s used for transaction fees, staking, DeFi protocols, and gaming applications.

And here’s the kicker: the Telegram connection still matters. Even though Telegram officially stepped away, the integration between Telegram’s massive user base and TON’s blockchain creates a fast-track for web3 onboarding that most other Layer-1s can only dream about.

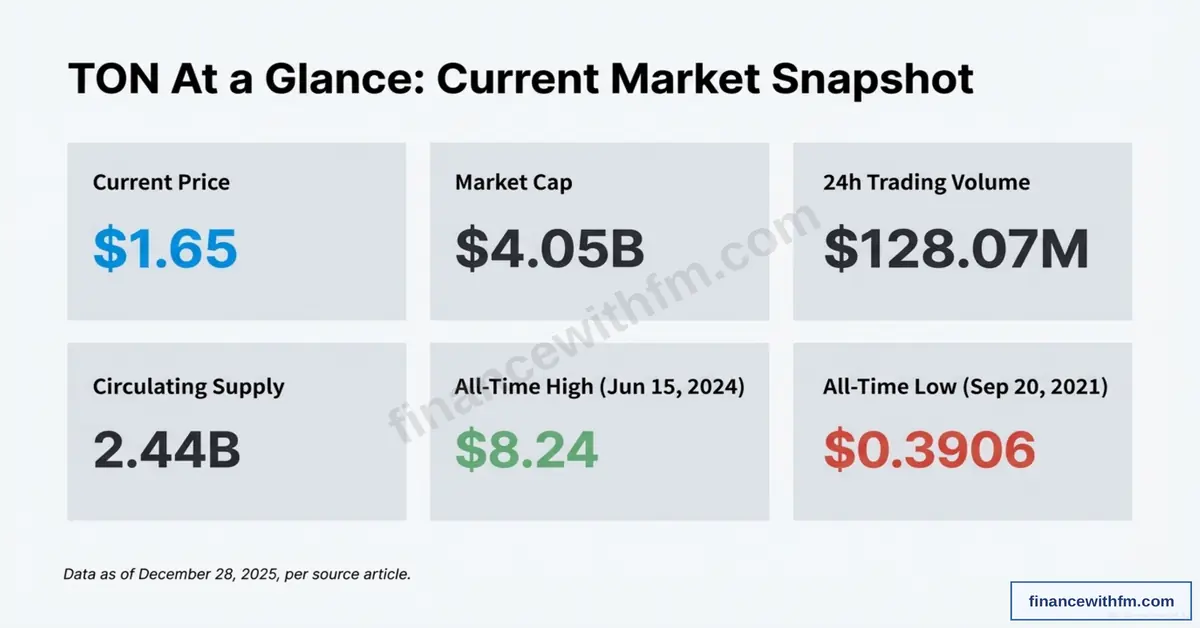

Current Market Reality: Where TON Stands Today

Let’s ground ourselves in reality before we talk about $48 price targets.

As of December 28, 2025, here’s where Toncoin stands:

- Current Price: $1.65

- Market Cap: $4.05 billion

- 24h Trading Volume: $128.07 million

- Circulating Supply: 2.44 billion TON

- All-Time High: $8.24 (June 15, 2024)

- All-Time Low: $0.3906 (September 20, 2021)

TON is down 80% from its all-time high. That’s brutal, but not unusual in crypto. Bitcoin has had multiple 80%+ drawdowns in its history. Ethereum too.

The question isn’t whether TON can recover—it’s whether the fundamentals support a recovery to new all-time highs and beyond.

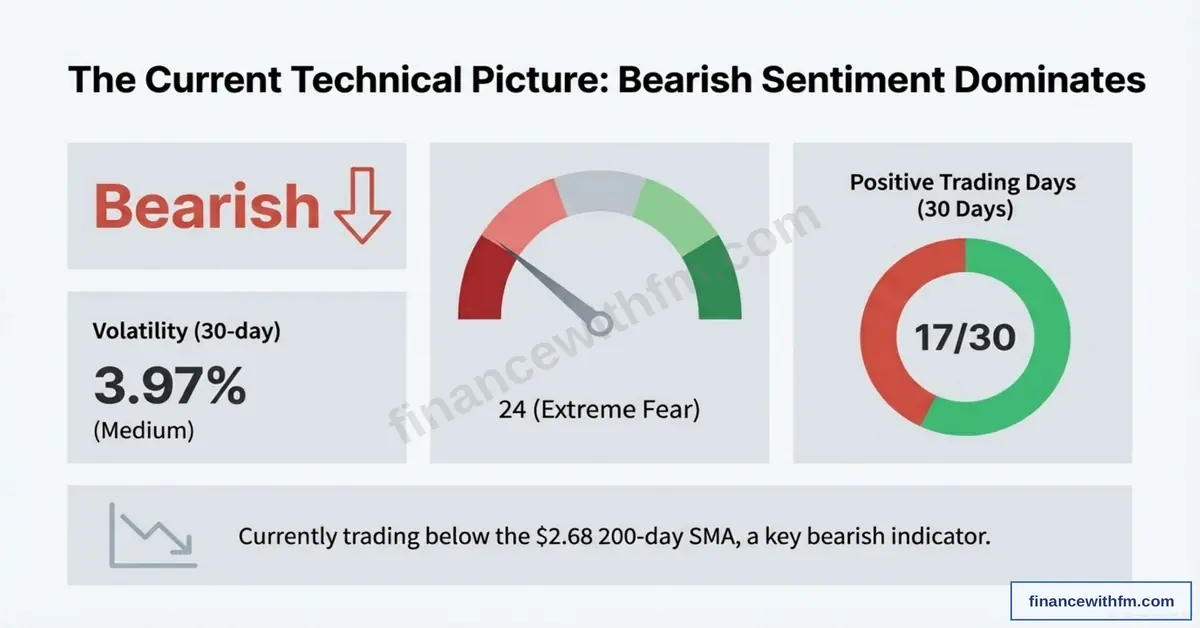

The Technical Picture: Why Bearish Sentiment Dominates Right Now

I’m not going to sugarcoat this. The short-term technicals are bearish.

Here’s what the charts are telling us:

Sentiment: Bearish. The Fear & Greed Index sits at 24, which is classified as “Extreme Fear.” When everyone’s scared, that’s usually when opportunities emerge—but it also means more downside is possible.

Volatility: 3.97% over the last 30 days. That’s medium volatility, which is actually lower than you’d expect for a crypto asset in a bear phase. Volatility compression often precedes big moves—up or down.

Positive Trading Days: Only 17 out of the last 30 days closed green. That’s 57%, which is barely above break-even. Not a strong trend in either direction.

200-Day SMA: TON is currently trading below the $2.68 200-day simple moving average. This is a key bearish indicator. In technical analysis, trading below the 200-day SMA signals that the long-term trend is down.

So if the technicals are bearish, why am I talking about a long-term bullish forecast? Because short-term price action and long-term fundamentals often diverge. The best buying opportunities usually come when technicals are bearish but fundamentals are strong.

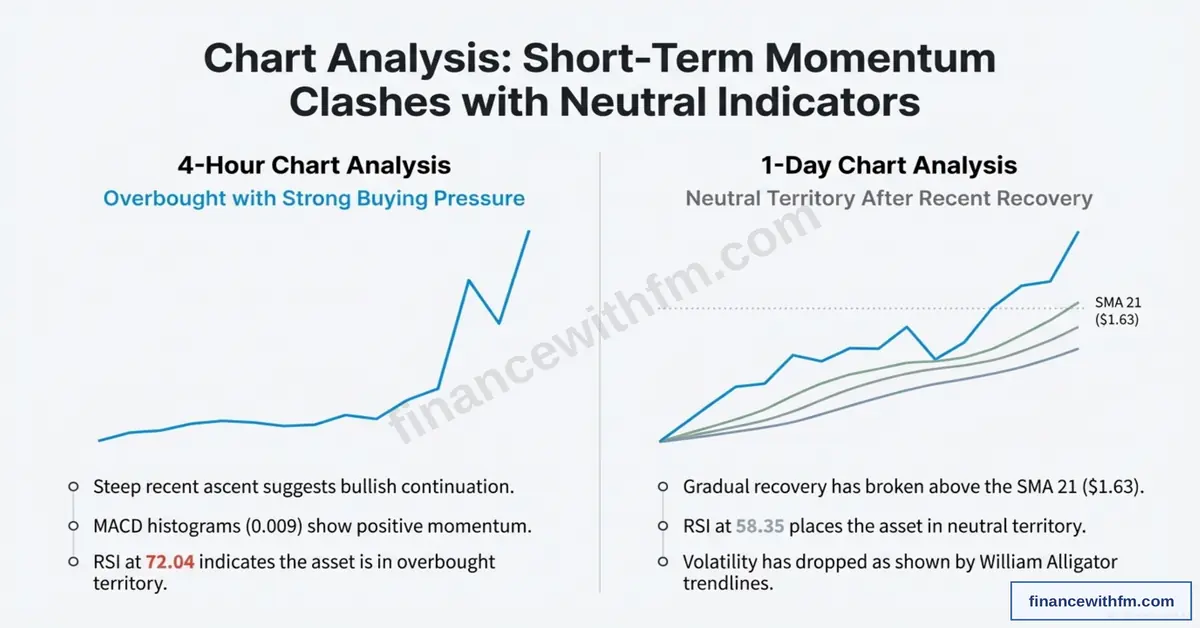

Chart Analysis: Short-Term Momentum vs. Neutral Indicators

Let’s zoom into the shorter timeframes because there’s a conflict brewing.

4-Hour Chart Analysis:

The 4-hour chart shows TON is overbought with strong buying pressure. The recent steep ascent suggests bullish continuation could be in play. MACD histograms at 0.009 show positive momentum. But here’s the problem: the RSI is at 72.04, which means the asset is in overbought territory. That’s a warning sign that a pullback could be coming.

1-Day Chart Analysis:

The daily chart tells a different story. TON has broken above the SMA 21 at $1.63, which is a short-term bullish signal. The RSI at 58.35 places the asset in neutral territory—not overbought, not oversold. Volatility has dropped as shown by William Alligator trendlines, which often precedes a breakout (or breakdown).

So what does this mean?

Short-term traders should be cautious. The 4-hour overbought condition suggests a pullback is likely before any sustained move higher. But for long-term holders, these short-term fluctuations are noise. The daily chart breaking above SMA 21 is a positive sign that the worst might be behind us—at least for now.

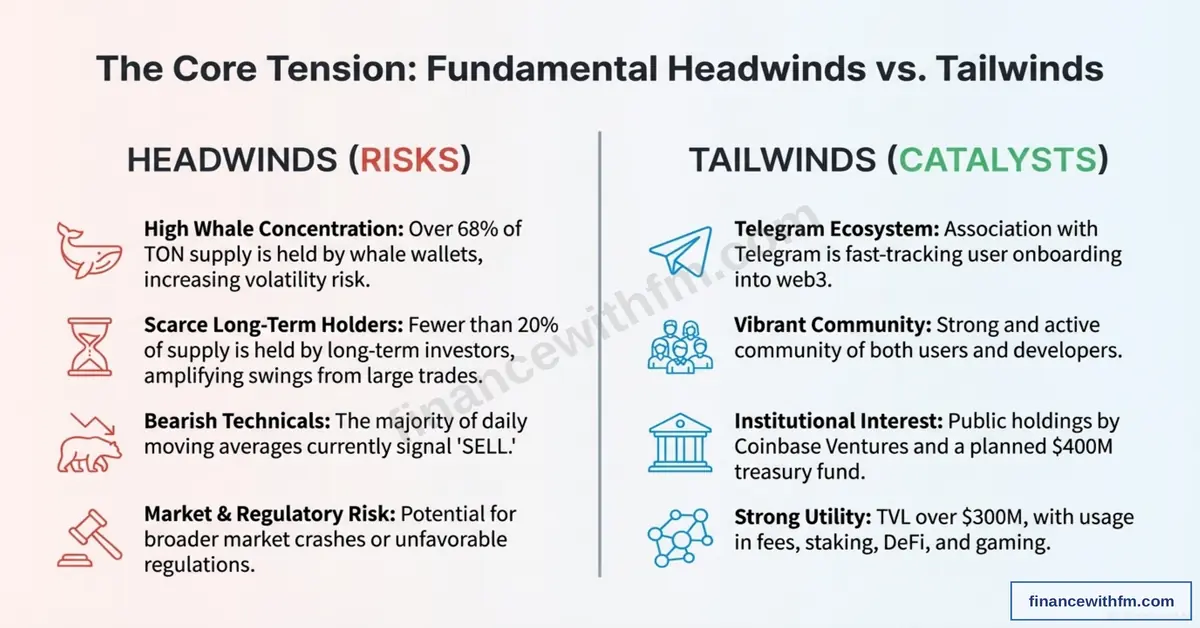

The Core Tension: Fundamental Headwinds vs. Tailwinds

Here’s where it gets interesting. And by interesting, I mean this is where you need to pay attention.

Every investment has risks and catalysts. Toncoin is no different. Let’s break down both sides honestly.

⚠️ Headwinds (Risks)

1. High Whale Concentration: Over 68% of TON’s supply is held by whale wallets. This creates massive volatility risk. If a few large holders decide to sell, the price could crater. This isn’t speculation—it’s math. Low distribution = high manipulation potential.

2. Scarce Long-Term Holders: Fewer than 20% of supply is held by long-term investors. That means most holders are short-term traders or speculators. This amplifies price swings from large trades. Long-term holders provide stability. TON doesn’t have enough of them yet.

3. Bearish Technicals: As we covered, the majority of daily moving averages currently signal “SELL.” Trading below the 200-day SMA is a red flag. Until TON reclaims key technical levels, the path of least resistance is down.

4. Market & Regulatory Risk: Crypto remains vulnerable to broader market crashes (if stocks tank, crypto usually follows) and unfavorable regulations. Governments are still figuring out how to handle crypto, and that uncertainty is a constant threat.

✅ Tailwinds (Catalysts)

1. Telegram Ecosystem: This is the big one. Telegram has over 700 million users. Even if a small fraction adopts TON for payments, staking, or DeFi, that’s a massive addressable market. The integration is already happening—Telegram’s wallet supports TON, and developers are building mini-apps on the platform. This is a distribution channel most Layer-1s would kill for.

2. Vibrant Community: TON has a strong, active community of both users and developers. Community-driven projects tend to outlast hype-driven ones. The fact that TON survived Telegram’s official exit and continued to grow is a testament to community strength.

3. Institutional Interest: Coinbase Ventures holds TON publicly. There’s a planned $400M treasury fund to support ecosystem growth. Institutional backing provides credibility and resources that retail-only projects lack.

4. Strong Utility: Total Value Locked (TVL) exceeds $300M. That’s real usage—not just speculation. TON is being used for transaction fees, staking, DeFi protocols, and gaming. Utility drives long-term value. Speculation drives short-term pumps. TON has both, but the utility foundation is what matters for a 6-year forecast.

So which side wins? That’s the $4 billion question (literally—that’s TON’s current market cap). The long-term forecast assumes the tailwinds outweigh the headwinds over a 6-year period. But in the short term, those headwinds are very real.

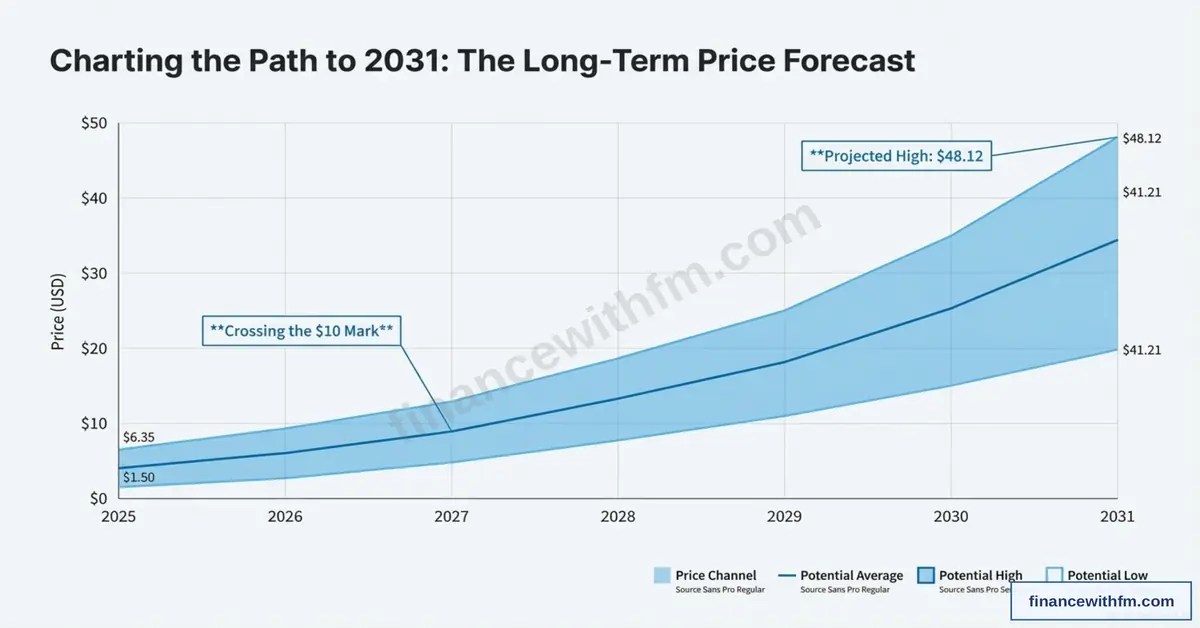

Charting the Path to 2031: The Long-Term Price Forecast

Alright, let’s get into the meat of this analysis. The price projections.

This forecast uses a combination of historical price patterns, Elliott Wave analysis, Fibonacci extensions, fundamental growth assumptions, and comparative valuation against other Layer-1 blockchains. It’s not perfect—no forecast is—but it’s data-driven.

Let’s break it down year by year:

2025: Potential low of $1.50, potential high of $6.35, base case around $4.23. This assumes a recovery from the current bear phase as the broader crypto market stabilizes. The $6.35 target would represent a full retracement of the recent decline and a test of previous resistance levels.

2026: Expected range of $6.58-$7.71, with a base case of $6.80. This is a consolidation year where TON builds a foundation for the next leg up. Sideways price action with gradual accumulation.

2027: Expected range of $9.26-$11.49, with a base case of $9.60. This is when TON crosses the psychological $10 barrier. Historically, breaking round numbers triggers FOMO and accelerates momentum. If the Telegram integration deepens and DeFi adoption grows, $10+ is very achievable.

2028: Expected range of $13.84-$16.29, with a base case of $14.22. The growth rate accelerates as network effects kick in. More users → more developers → more applications → more users. This is the flywheel effect.

2029: Expected range of $20.71-$23.42, with a base case of $21.27. By this point, TON would be firmly established as a top-10 cryptocurrency by market cap (assuming it isn’t already). Institutional adoption likely increases.

2030: Expected range of $28.31-$34.81, with a base case of $29.16. This is where the forecast gets aggressive. A $30 TON would put the market cap around $73 billion (assuming similar circulating supply). For context, Solana peaked at $77 billion. It’s ambitious but not impossible.

2031: Potential low of $41.21, potential high of $48.12, base case of $42.37. The $48 target assumes TON achieves widespread adoption, maintains its Telegram integration advantage, and benefits from a broader crypto bull market. At $48, TON’s market cap would be around $117 billion—comparable to Ethereum’s market cap in previous cycles.

Is this guaranteed? Absolutely not. Crypto is unpredictable. But is it possible? Yes. And the risk-reward at current levels makes it worth considering for long-term portfolios.

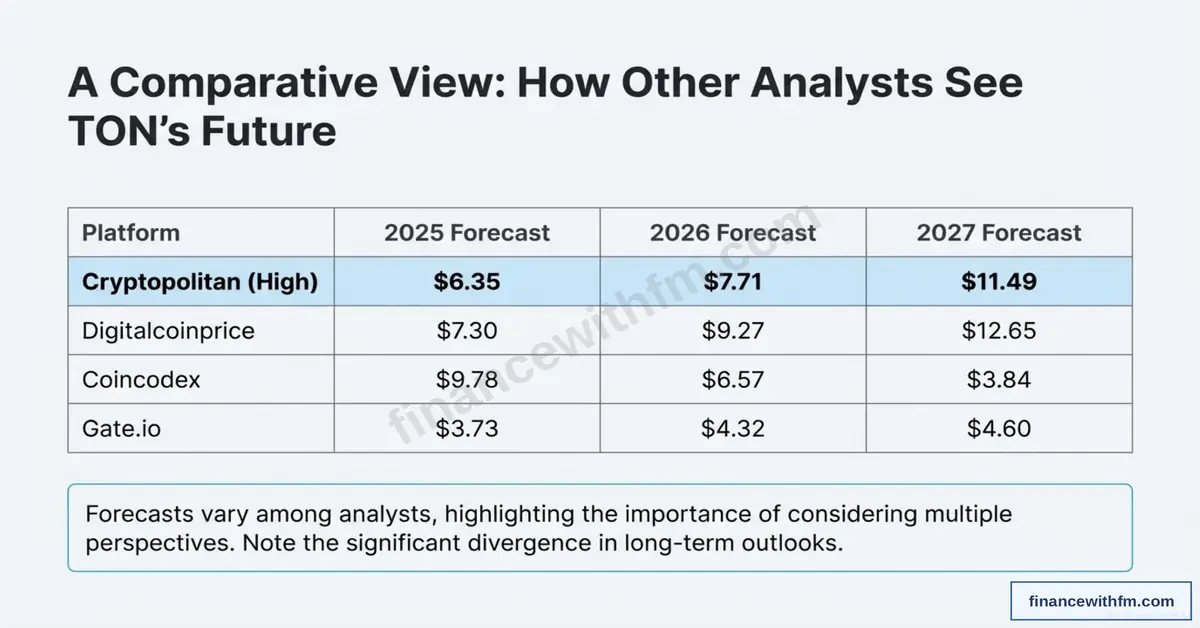

How Other Analysts See TON’s Future (Spoiler: They Disagree)

I’m not the only one forecasting TON’s price. Let’s see what other analysts are saying—because the divergence is massive.

Cryptopolitan (High Scenario): 2025: $6.35 | 2026: $7.71 | 2027: $11.49. This aligns closely with the forecast I’m presenting. They’re bullish on TON’s Telegram integration and ecosystem growth.

Digitalcoinprice: 2025: $7.30 | 2026: $9.27 | 2027: $12.65. Slightly more aggressive than Cryptopolitan, projecting faster near-term growth. Their model likely weights momentum and adoption curves more heavily.

Coincodex: 2025: $9.78 | 2026: $6.57 | 2027: $3.84. Wait, what? Coincodex is projecting a decline from 2025 to 2027. This is a bearish outlier. Their model might be purely technical, ignoring fundamentals, or they’re factoring in a prolonged crypto winter scenario.

Gate.io: 2025: $3.73 | 2026: $4.32 | 2027: $4.60. Conservative and slow growth. Gate.io’s forecast suggests skepticism about TON’s ability to break out significantly. They might be factoring in high competition from other Layer-1s.

What does this divergence tell us?

Forecasting crypto prices is hard. Really hard. The wide range of predictions reflects different methodologies, assumptions, and biases. Some analysts focus on technicals, others on fundamentals, and some just extrapolate recent trends. The lesson? Don’t rely on any single forecast (including mine). Consider multiple perspectives, understand the reasoning behind each, and make your own informed decision.

The Journey So Far: A Brief History of Toncoin

Context matters. Let’s look at where TON has been to understand where it might go.

2018: Toncoin launched as Telegram Open Network. Telegram raised $1.7 billion in an ICO—one of the largest in crypto history. The vision was ambitious: a blockchain integrated with Telegram’s messaging platform.

2020-2022: After regulatory battles with the SEC, Telegram officially exited the project. But the community didn’t quit. They took over development and mined 98.55% of the supply through Giver smart contracts. This community-driven phase proved TON’s resilience.

September 2021: TON hit its all-time low of $0.3906. This was peak fear. Anyone who bought here and held to the June 2024 high made 21x.

November 2021: First significant breakout run from $0.80 to $4.50. This was TON’s introduction to the broader crypto market. It proved the project had legs.

June 2024: TON reached its all-time high of $8.24. This coincided with renewed interest in Telegram-integrated crypto applications and a broader altcoin rally.

2025: TON entered the year at $5.50, then dropped to the current $1.60. This bear phase has shaken out weak hands and created a potential accumulation zone for long-term investors.

The pattern is clear: TON has survived multiple challenges, recovered from deep drawdowns, and continued to build. That’s the behavior of a project with staying power, not a pump-and-dump scheme.

Risk Management: How to Approach This Opportunity

Let’s talk about how to actually trade or invest in TON without getting wrecked.

If the long-term thesis is correct, current levels around $1.65 represent a potential accumulation zone. But “potential” doesn’t mean guaranteed. Here’s how to manage risk:

1. Position Sizing: Never allocate more than 5-10% of your crypto portfolio to any single altcoin. TON is promising, but it’s still high-risk. If you’re wrong, you need to survive to trade another day.

2. Dollar-Cost Averaging: Instead of buying all at once, spread your purchases over weeks or months. If TON drops to $1.20, you’ll be glad you didn’t go all-in at $1.65. If it rallies to $2.50, you’ll still have a position.

3. Time Horizon: This is a 2-6 year play, not a 2-week trade. If you need the money in the next year, don’t invest it in TON. Crypto is volatile. You need time for the thesis to play out.

4. Stop Loss (for traders): If you’re actively trading rather than holding long-term, set a stop loss below key support levels. A close below $1.20 would be a warning sign that the bearish phase is deepening.

5. Take Profits: If TON rallies to $6.35 in 2025 (the projected high), consider taking some profits. You don’t have to sell everything, but locking in gains along the way reduces risk and gives you dry powder for corrections.

⚠️ Risk Reality Check: Crypto is volatile. This analysis could be completely wrong. The 68% whale concentration means a few large holders could dump and crash the price. Bearish technicals suggest more downside is possible before any sustained recovery. Never invest more than you can afford to lose. Use proper position sizing. Don’t leverage beyond your risk tolerance. Market conditions change fast—what’s true today might not be tomorrow. This is not financial advice. Do your own research.

Watch the Full Video Analysis

I break down the charts, technical levels, and fundamental catalysts in detail in this video. If you want to see the Elliott Wave count, Fibonacci levels, and on-chain metrics I’m tracking, check it out:

Frequently Asked Questions

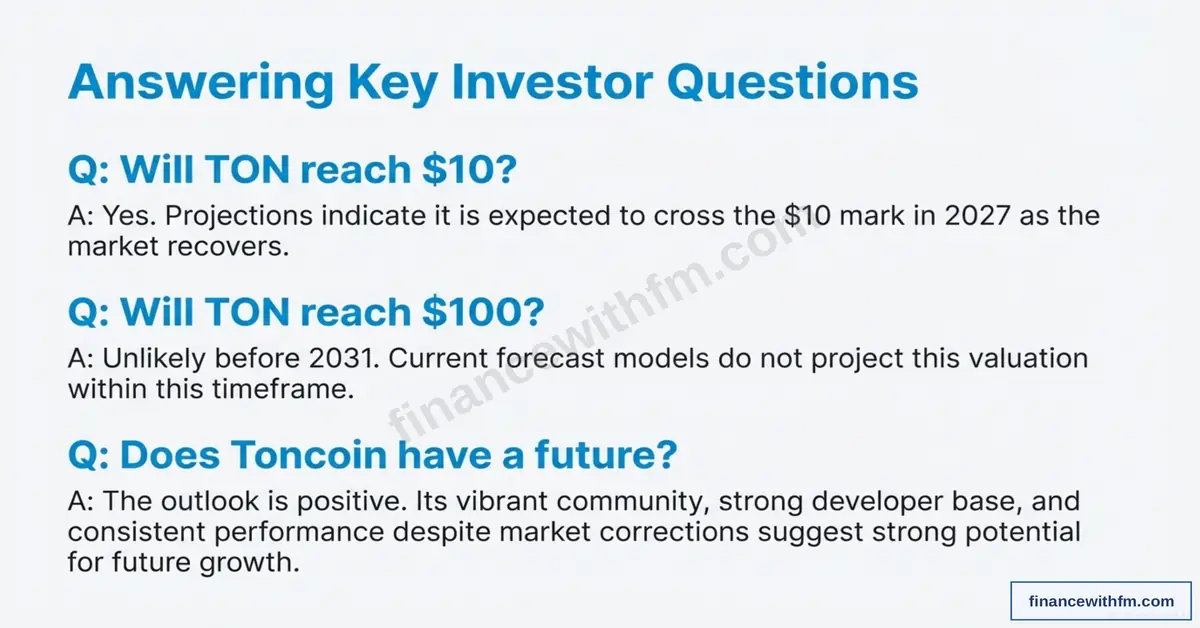

Will Toncoin reach $10?

Yes, projections indicate TON is expected to cross the $10 mark in 2027 as the market recovers from the current bearish phase. The expected range for 2027 is $9.26-$11.49, with the base case scenario pointing toward $9.60. This assumes continued ecosystem growth, sustained Telegram integration, and broader crypto market recovery. However, this is a forecast, not a guarantee—market conditions can change rapidly.

Will Toncoin reach $100 before 2031?

Unlikely. Current forecast models do not project TON reaching $100 within this timeframe. The highest projection for 2031 is $48.12, with the base case at $42.37. Reaching $100 would require approximately 60x growth from current levels ($1.65), which would demand extraordinary catalysts beyond what’s currently visible in the data. Never say never in crypto, but the probability is low based on current fundamentals.

What are the biggest risks to Toncoin’s price growth?

The primary risks are: (1) High whale concentration—over 68% of TON supply is held by whale wallets, creating volatility risk and potential for large sell-offs. (2) Scarce long-term holders—fewer than 20% of supply is held by long-term investors, amplifying price swings. (3) Current bearish technicals—the majority of daily moving averages signal ‘SELL’, and TON is trading below the critical $2.68 200-day SMA. (4) Broader market and regulatory risk—crypto remains vulnerable to macro crashes and unfavorable regulations. These headwinds must be weighed against the long-term tailwinds.

Why is Toncoin bearish right now despite long-term bullish projections?

Short-term bearish sentiment dominates due to several factors: TON entered 2025 at $5.50 and has dropped to $1.60, a significant decline. Current volatility is 3.97% (medium), with a Fear & Greed Index reading of 24 (Extreme Fear). The asset is trading below the $2.68 200-day SMA, a key bearish indicator. Only 17 out of the last 30 trading days were positive. However, the 4-hour chart shows overbought conditions with strong buying pressure (RSI at 72.04), suggesting a potential short-term bounce. The bearish phase is typical after a parabolic run to $8.24 in June 2024. Long-term fundamentals remain intact.

How do other analysts’ Toncoin predictions compare?

Forecasts vary significantly among analysts. For 2025, Cryptopolitan projects $6.35 (high), Digitalcoinprice forecasts $7.30, Coincodex predicts $9.78, and Gate.io estimates $3.73. For 2027, projections range from $3.84 (Coincodex) to $12.65 (Digitalcoinprice), with Cryptopolitan at $11.49. This divergence highlights the uncertainty inherent in long-term crypto predictions. The wide range reflects different methodologies—some focus purely on technical analysis, others on fundamental valuation, and some on sentiment-driven models. Always consider multiple perspectives and do your own research.

What makes Toncoin fundamentally strong for long-term growth?

Toncoin’s long-term strength comes from several key factors: (1) Telegram ecosystem integration—association with Telegram’s 700M+ users provides a fast-track for web3 onboarding. (2) Vibrant community—strong, active community of both users and developers building on TON. (3) Institutional interest—public holdings by Coinbase Ventures and a planned $400M treasury fund signal confidence. (4) Strong utility—Total Value Locked (TVL) exceeds $300M, with real usage in transaction fees, staking, DeFi protocols, and gaming. (5) Technology—a distributed ‘supercomputer’ protocol composed of TON Blockchain, TON DNS, TON Storage, and TON Sites enables rapid transactions and supports decentralized applications. These fundamentals create a foundation for long-term value appreciation.

Should I buy Toncoin now at $1.65?

I can’t tell you what to do with your money—I’m not your financial advisor. But here’s what the data shows: at $1.65, TON is 80% below its all-time high of $8.24 and significantly below the 2025 projected high of $6.35. If the long-term forecast is accurate, current levels represent a potential accumulation zone. However, short-term risks are real: bearish technicals, high whale concentration, and extreme fear in the market. If you’re considering entry, think about dollar-cost averaging rather than lump-sum buying, use proper position sizing (never more than you can afford to lose), and set clear stop-loss levels. The long-term thesis is compelling, but the short-term path could be volatile. Do your own research and trade at your own risk.